How To Implement Crystal In Finance: Enhancing Visibility And Control In Financial Operations

In the financial sector, clarity and precision are fundamental to making sound decisions. As organizations grow, financial processes become more complex, involving numerous stakeholders, stringent compliance requirements, and fast-paced decision-making.

This complexity demands tools that provide a clear overview and seamless collaboration to keep financial projects and workflows on track.

Crystal, a concept representing clarity and transparency in finance, is critical for finance teams aiming to improve operational efficiency and risk management.

To truly understand the value of crystal-clear financial processes, it’s important to examine the common challenges finance teams face and how enhanced visibility can address these issues. By exploring practical approaches such as visual workflow management and flexible tools tailored for finance, organizations can see how transparency fosters better collaboration, accountability, and overall operational success.

In the following sections, we’ll explore how implementing Crystal can help financial institutions enhance project clarity, streamline workflows, and boost overall productivity.

The Importance of Transparency in Finance

Finance teams handle sensitive data, manage budgets, oversee reporting, and ensure compliance with various regulations. Without transparency, teams risk miscommunication, delayed approvals, and errors that can impact financial health and strategic outcomes.

Transparency in finance means everyone involved—from CFOs to operations managers—has access to relevant, up-to-date information about ongoing tasks, budgets, and deadlines.

Crystal-like visibility in financial workflows allows teams to monitor progress clearly, identify bottlenecks early, and collaborate effectively. This level of insight supports better resource allocation and enables proactive adjustments, helping avoid costly mistakes and ensuring smoother operations.

Common Challenges Finance Teams Face

Several challenges can obstruct transparency and control in finance:

- Fragmented Workflows: Financial operations often span multiple departments and systems. Without a unified view, tracking tasks and deadlines becomes difficult.

- Compliance and Audit Readiness: Managing regulatory compliance, requirements demands meticulous documentation and easy access to audit trails.

- Delayed Decision-Making: Lack of real-time updates causes delays in approvals and financial reporting.

- Collaboration Barriers: Siloed teams struggle to coordinate, leading to duplicated efforts or overlooked tasks.

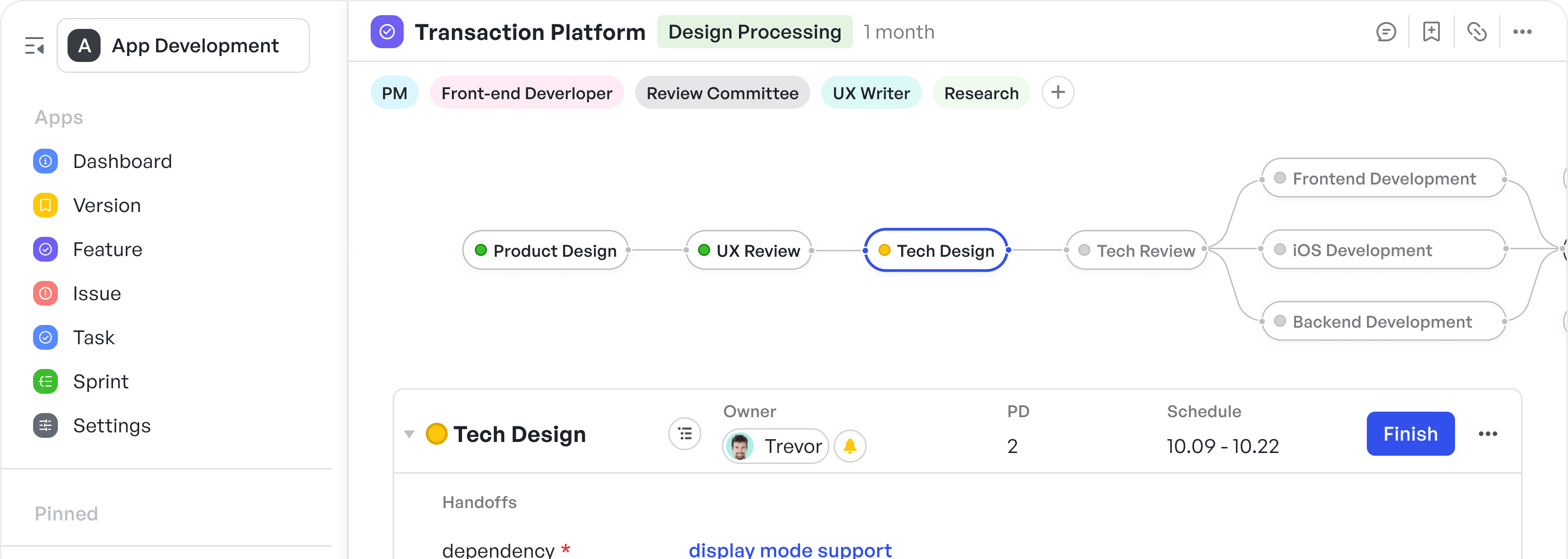

Meegle's Regulatory Compliance Audit Template

Meegle's Regulatory Compliance Audit TemplateAddressing these challenges requires a solution that balances complexity with ease of use, providing a clear view of all financial processes while supporting collaboration.

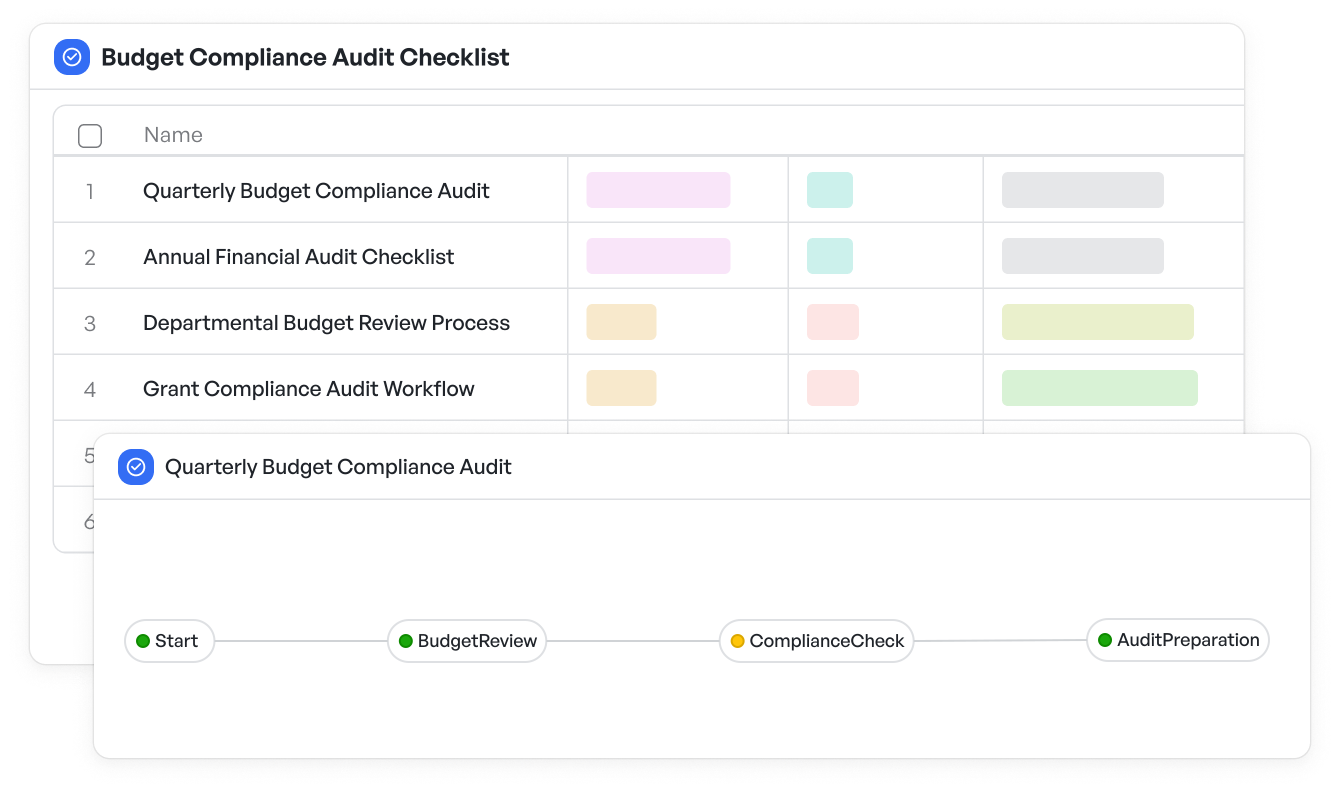

Visual Workflow Management for Finance

Visual workflows provide an intuitive way to organize financial processes, mapping out each step clearly and showing responsibilities, deadlines, and progress status. This approach reduces ambiguity and helps every team member understand where their input fits into the bigger picture.

In finance, visual workflows can be applied to:

- Budget planning and tracking

- Expense approvals

- Financial reporting cycles

- Compliance checklists

- Risk management processes

By visualizing these workflows, finance teams gain a comprehensive perspective of the entire process, improving coordination and transparency.

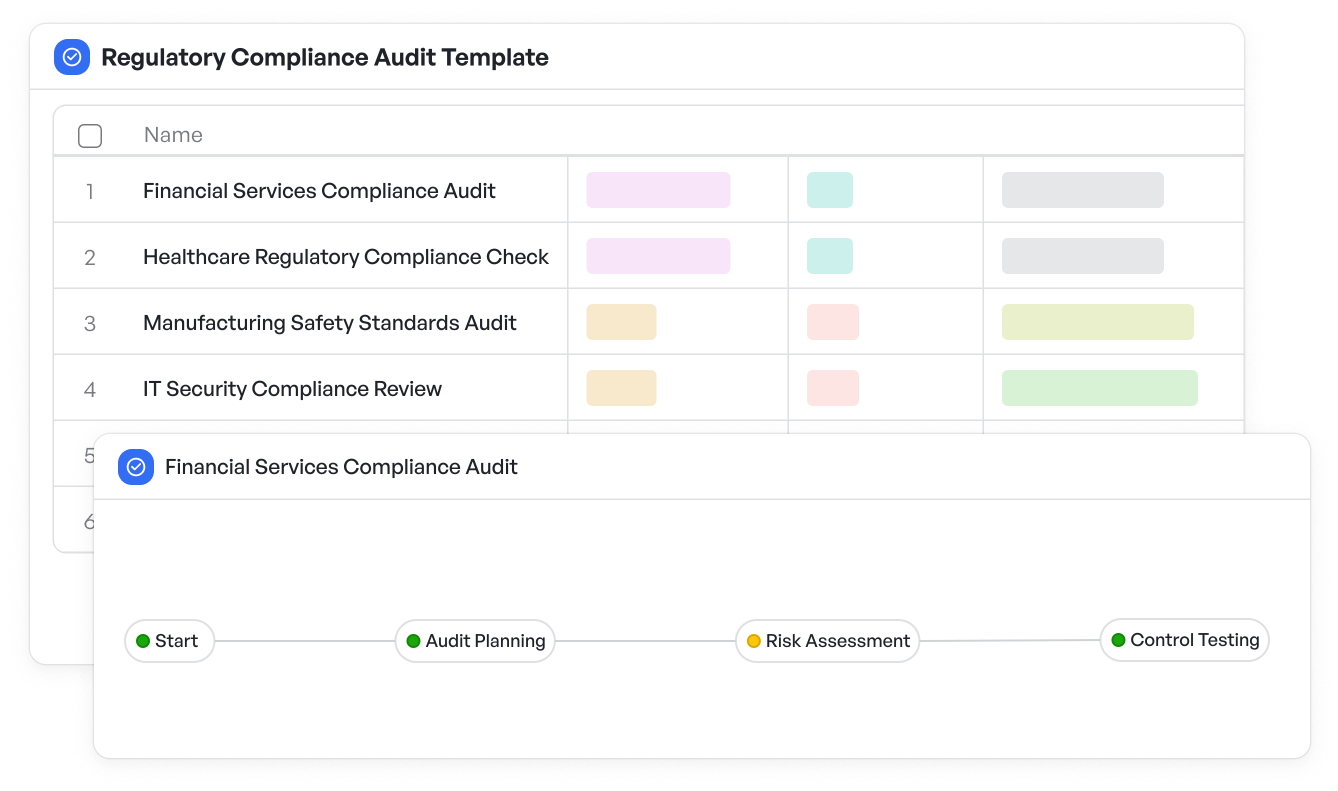

Meegle's template for Digital transformation in finance

Meegle's template for Digital transformation in finance Suggested Read:👉The Best Workflow Management Software Tools in 2025

Why Flexibility Matters in Finance Tools

Financial operations vary greatly across industries and organizations. Financial tools that are rigid or overly complex often fail to address unique business needs. Meanwhile, simple tools might lack the capability to manage intricate financial processes.

A flexible tool balances the ability to handle complexity with a user-friendly design. This allows finance teams to customize workflows to their specific processes without a steep learning curve. Such flexibility fosters quicker adoption and reduces dependence on IT or external consultants.

How Teams Benefit from Clarity and Collaboration

When finance teams work with clarity on their workflows:

- Improved Accountability: Clear task ownership and timelines reduce missed deadlines and errors.

- Faster Approvals: Real-time visibility into approval stages shortens cycle times.

- Better Risk Management: Early detection of delays or compliance gaps lowers risk exposure.

- Enhanced Cross-Departmental Workflows: Seamless collaboration between finance, operations, and legal improves efficiency.

These improvements translate into cost savings, improved financial accuracy, and stronger governance.

Where Visual Workflow Tools Fit in Finance

Tools that offer visual workflows designed for finance make managing these processes more manageable and transparent.

For example, customizable templates specific to budgeting or compliance workflows can accelerate setup and standardize best practices across teams.

Such tools also provide audit trails and documentation capabilities, crucial for financial compliance and reporting requirements.

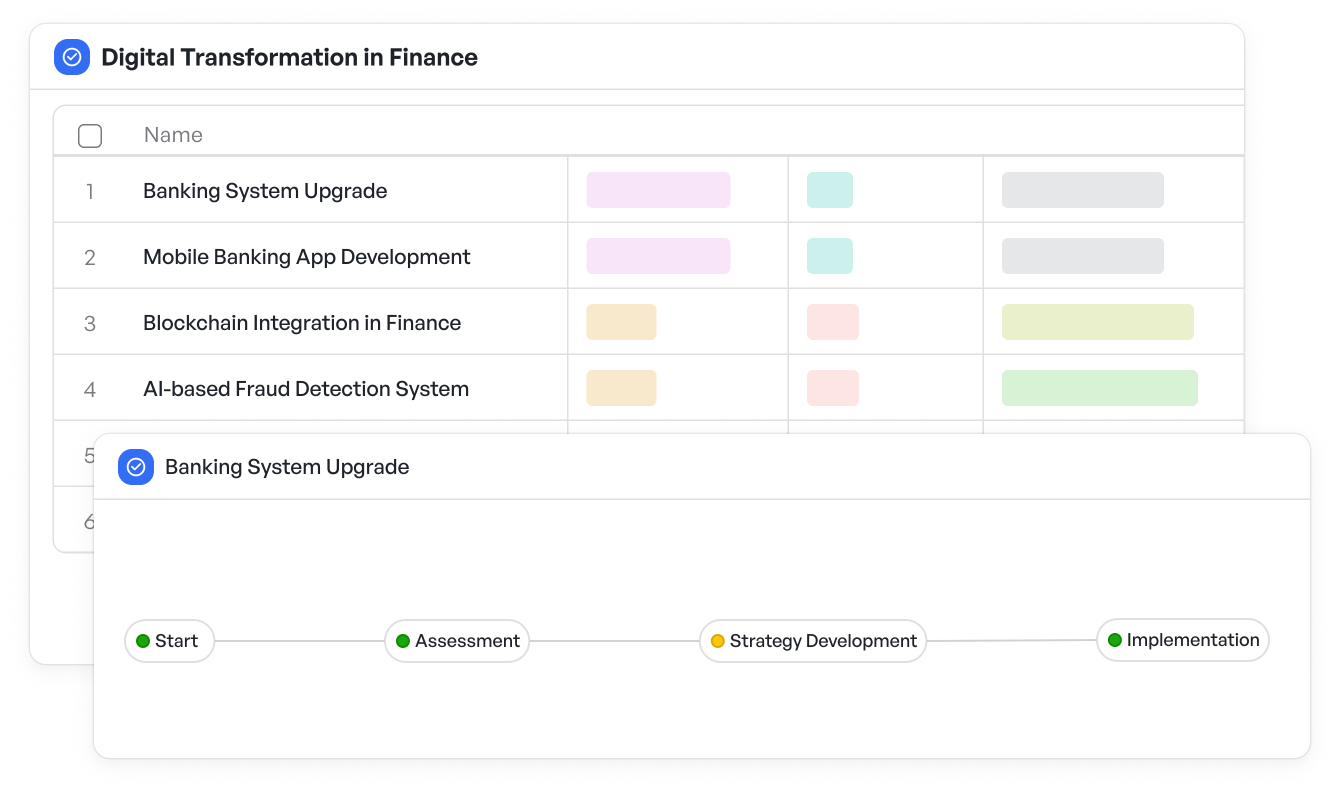

Budget compliance audit checklist in Meegle

Budget compliance audit checklist in MeegleSuggested Read:👉 7 Best Visual Project management software 2025

Integrating Crystal Clarity into Financial Operations

Adopting a workflow management tool that delivers crystal-clear visibility helps finance teams gain control over their complex processes without compromising usability.

Teams can track project status, ongoing tasks, and responsible collaborators in one place, with a visual interface that simplifies even the most complicated financial workflows.

While some solutions either overwhelm users with complexity or fall short in handling detailed processes, a balanced platform provides both depth and ease of use, helping teams work efficiently and confidently.

Achieve Operational Excellence with Transparent Financial Workflows

Clear, visual workflows enable finance teams to manage complex processes with precision and collaboration. Achieving crystal clarity in financial operations leads to faster decision-making, enhanced compliance, and reduced risks—all vital for sustaining organizational growth and profitability.

Streamlining financial workflows with visual clarity empowers teams to collaborate effectively and stay aligned with organizational goals. This clarity improves communication, reduces bottlenecks, and supports a proactive approach to financial management.

Bring crystal clarity to finance—Meegle makes transparency and efficiency your new normal

The world’s #1 visualized project management tool

Powered by the next gen visual workflow engineRead More

Check All BlogsStart creating impactful work today