How to Implement Agile Modeling in Finance

Financial organizations today face mounting pressure to deliver accurate, timely results while adapting rapidly to market changes and regulatory demands. The intricate nature of finance projects, from risk assessments to compliance workflows, requires tools and methods that can handle complexity without sacrificing clarity or speed.

Agile modeling, a component of the broader Agile methodology, provides a structured yet flexible approach to navigating these challenges.

In this article, we explore the role of Agile modeling in finance, its benefits, and how mid-market and enterprise teams can adopt this approach to improve project outcomes and collaboration.

What Is Agile Modeling in Finance?

Agile modeling is a practice that uses lightweight, flexible modeling techniques to plan and communicate workflows, processes, and system designs. Unlike traditional methods that rely on heavy documentation, Agile modeling focuses on simple, flexible designs that evolve and adapt throughout the project lifecycle.

In finance, where projects often involve multiple stakeholders, complex regulatory requirements, and rapidly changing priorities, Agile modeling helps teams visualize workflows clearly and adapt to new information as it emerges. It complements Agile project management by focusing on visual clarity and collaboration, which are essential for cross-functional finance teams.

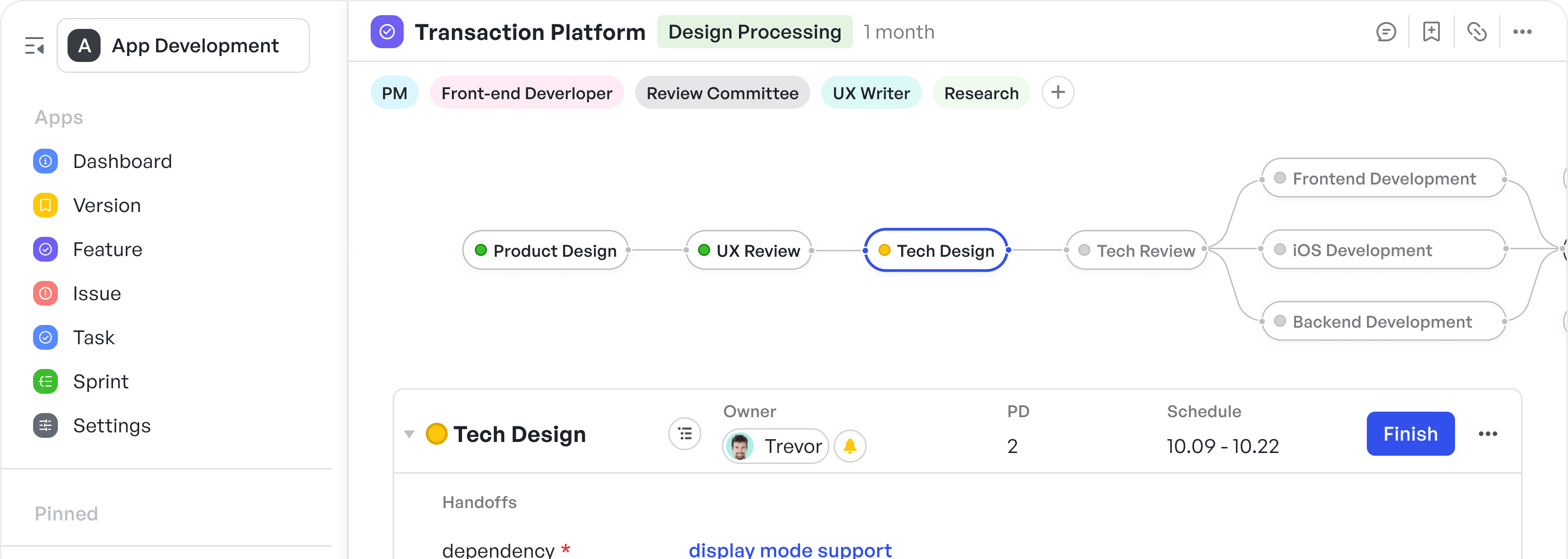

Agile methodology workflow diagram of a UX project

Agile methodology workflow diagram of a UX projectWhy Agile Modeling in Finance Matters for Mid-Market and Enterprise Teams

Finance projects in larger organizations often span multiple departments — compliance, audit, risk management, IT, and operations. Each group may have different views and priorities, which makes alignment difficult. Agile modeling addresses this by:

- Providing visual workflows that all team members can understand and follow

- Enabling rapid changes to models as project scope or regulatory requirements evolve

- Reducing misunderstandings and handoff errors between departments

- Accelerating decision-making with clear, collaborative models.

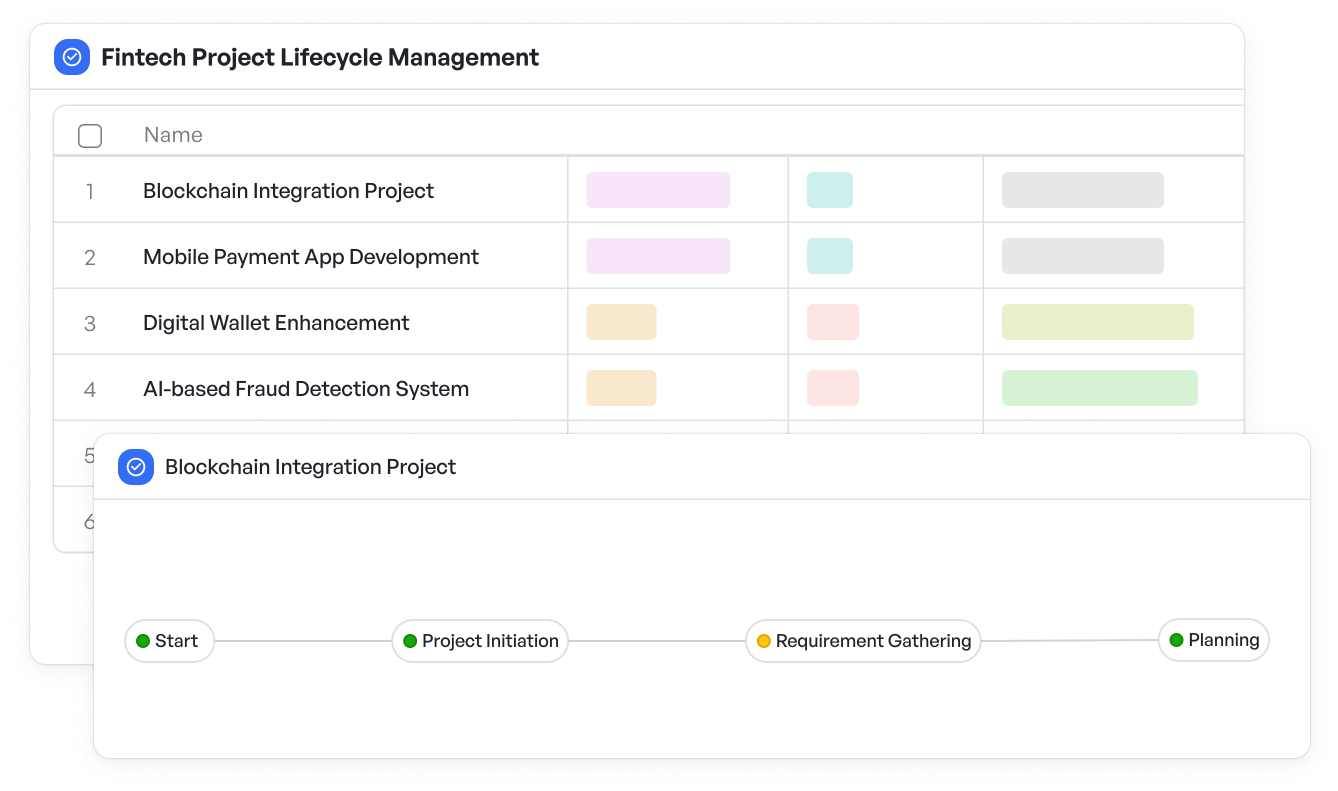

A practical way to support these Agile modeling benefits is by using the fintech project lifecycle management template. This template offers a ready-to-use visual workflow designed specifically for complex financial projects, helping teams map processes clearly, collaborate effectively, and adjust quickly as needs change.

Streamlines complex finance workflows with clear and adaptable visual models

Streamlines complex finance workflows with clear and adaptable visual modelsThese benefits support the goals of finance leaders like CFOs, operations directors, and project managers who need real-time visibility into project progress and risks without getting bogged down by complex documentation.

4 Key Benefits of Agile Modeling in Finance Projects

Adopting Agile modeling can lead to significant improvements in how finance teams manage their projects. Here are some core advantages:

1. Improved Clarity on Complex Workflows

Financial forecasting methods such as loan approval, budget forecasting, or regulatory reporting involve many steps and dependencies. Agile modeling helps map these out visually, so team members and stakeholders can quickly grasp the entire flow, their roles, and deadlines.

2. Enhanced Collaboration Across Departments

Visual models break down silos by providing a shared understanding of complex concepts. Teams from compliance to IT can work together, analyzing potential bottlenecks or risks early and suggesting improvements without confusion.

3. Flexibility to Adapt to Regulatory Changes

Finance regulations evolve frequently. Agile modeling supports ongoing updates to workflows, allowing teams to stay compliant without needing to restart documentation from scratch.

4. Faster Delivery of Financial Projects

By focusing on “just enough” documentation and iterative updates, Agile modeling reduces waste and accelerates project timelines. Teams spend less time on lengthy paperwork and more on execution.

How to Implement Agile Modeling in Finance in 5 Practical Steps

For mid-market and enterprise finance teams looking to start with Agile modeling, here are practical steps to guide the adoption:

Step 1: Identify Key Financial Workflows to Model

Begin by selecting high-impact processes that would benefit from visualization. Examples include:

- Budget approval cycles

- Risk management assessments

- Financial close and reporting

- Compliance workflows

Step 2: Gather Cross-Functional Stakeholders

Involve representatives from all relevant teams at an early stage. It can include teams like finance, compliance, IT, and operations. Their input is critical to capturing the full scope and dependencies.

Step 3: Create Initial Visual Models

Use visual workflow tools to map out the current process “as-is.” Focus on clarity, showing key tasks, decision points, and handoffs. Avoid over-documenting; the goal is a clear overview.

Step 4: Review and Refine Collaboratively

Share the model with all stakeholders for feedback. Use Agile iterations to refine the workflow, identify inefficiencies, and update as regulations or business needs evolve.

Step 5: Integrate Models into Agile Project Management

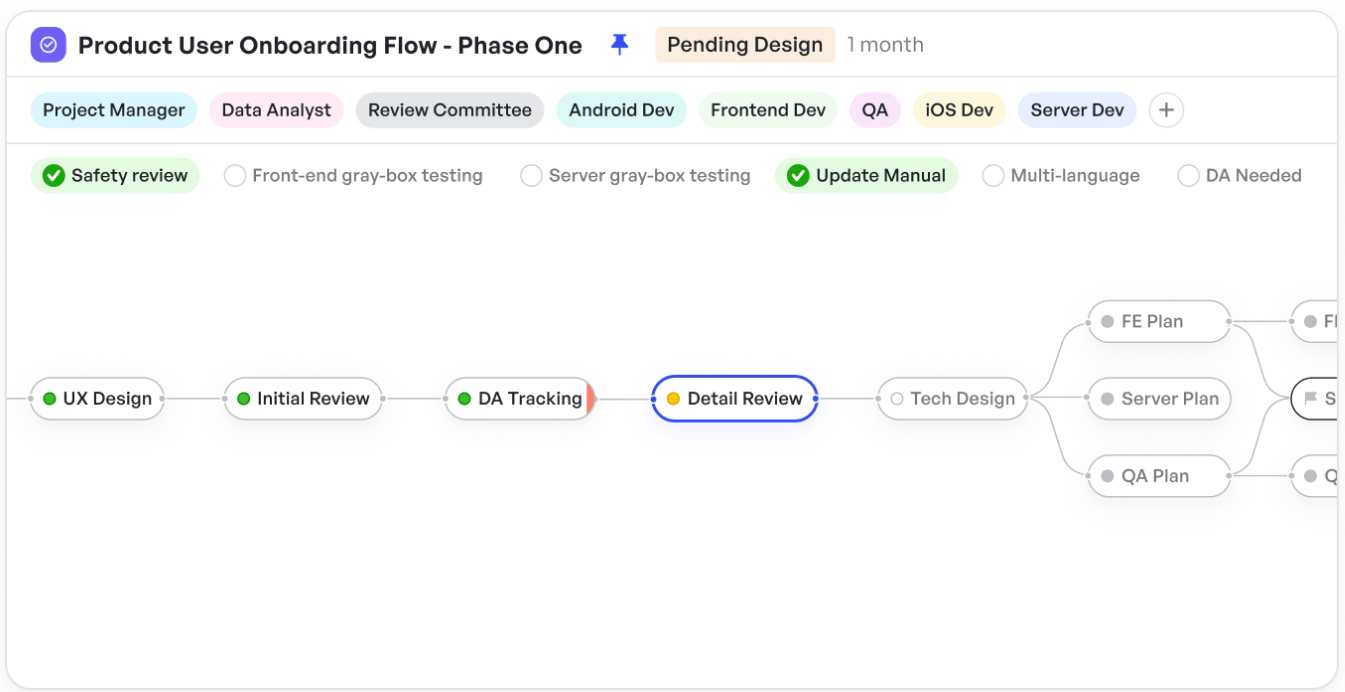

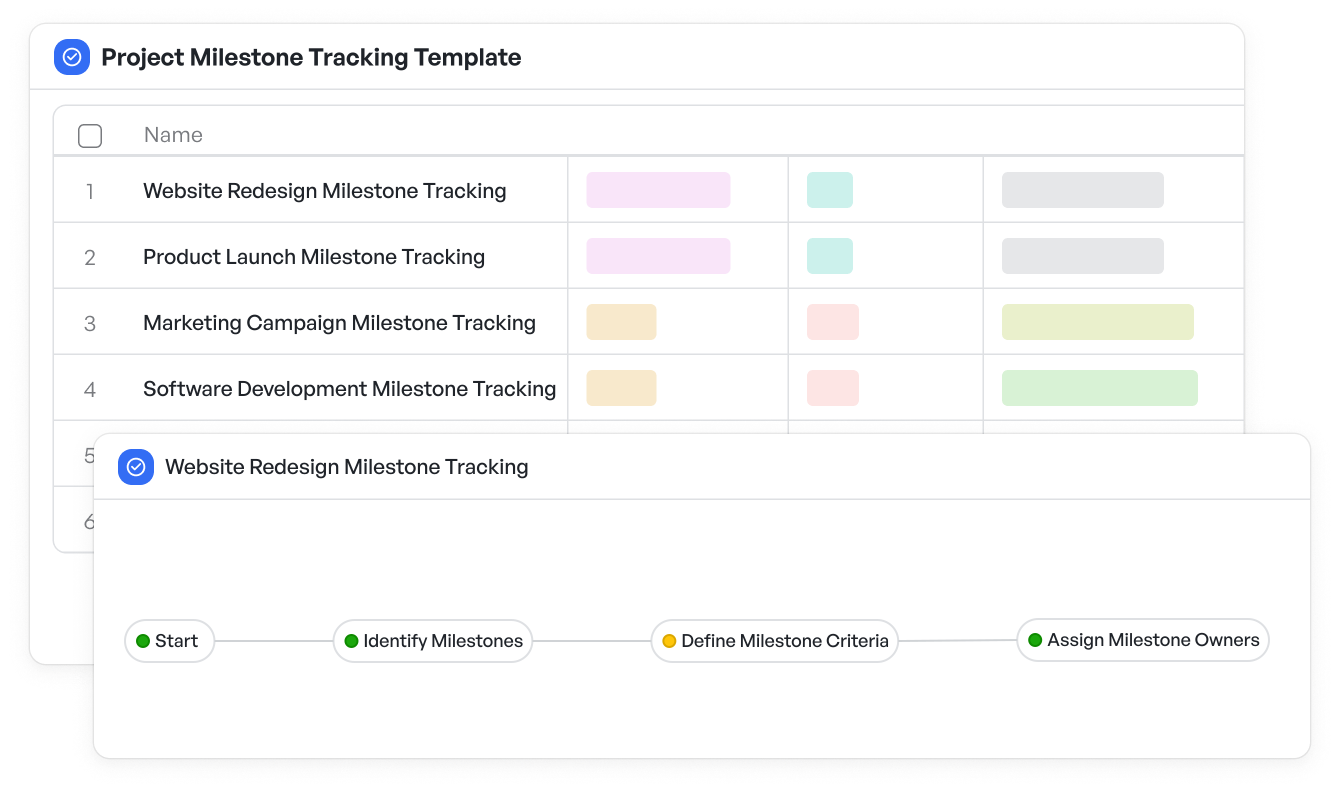

Connect your models to key project management tasks and milestones, creating a clear framework for your team’s workflow. This approach allows everyone to stay aligned with responsibilities and timelines. To effectively track milestones and deadlines in your Agile projects, consider using the project milestone tracking template for seamless project management.

Visualize key milestones and keep your Agile project aligned with goals using the project milestone tracking template

Visualize key milestones and keep your Agile project aligned with goals using the project milestone tracking templateBest Practices for Agile Modeling in Finance

While Agile modeling is flexible, following these best practices can improve results:

- Keep models lightweight and focused by avoiding overwhelming detail

- Use standardized symbols and terminology to reduce confusion

- Update models frequently to reflect real-time changes

- Leverage collaborative platforms to enable remote and cross-team participation

- Train teams on interpreting and contributing to models for better engagement.

Visual Workflow Templates: Supporting Agile Modeling in Finance

Visual workflow templates tailored to finance projects can jumpstart Agile modeling adoption. Templates can include:

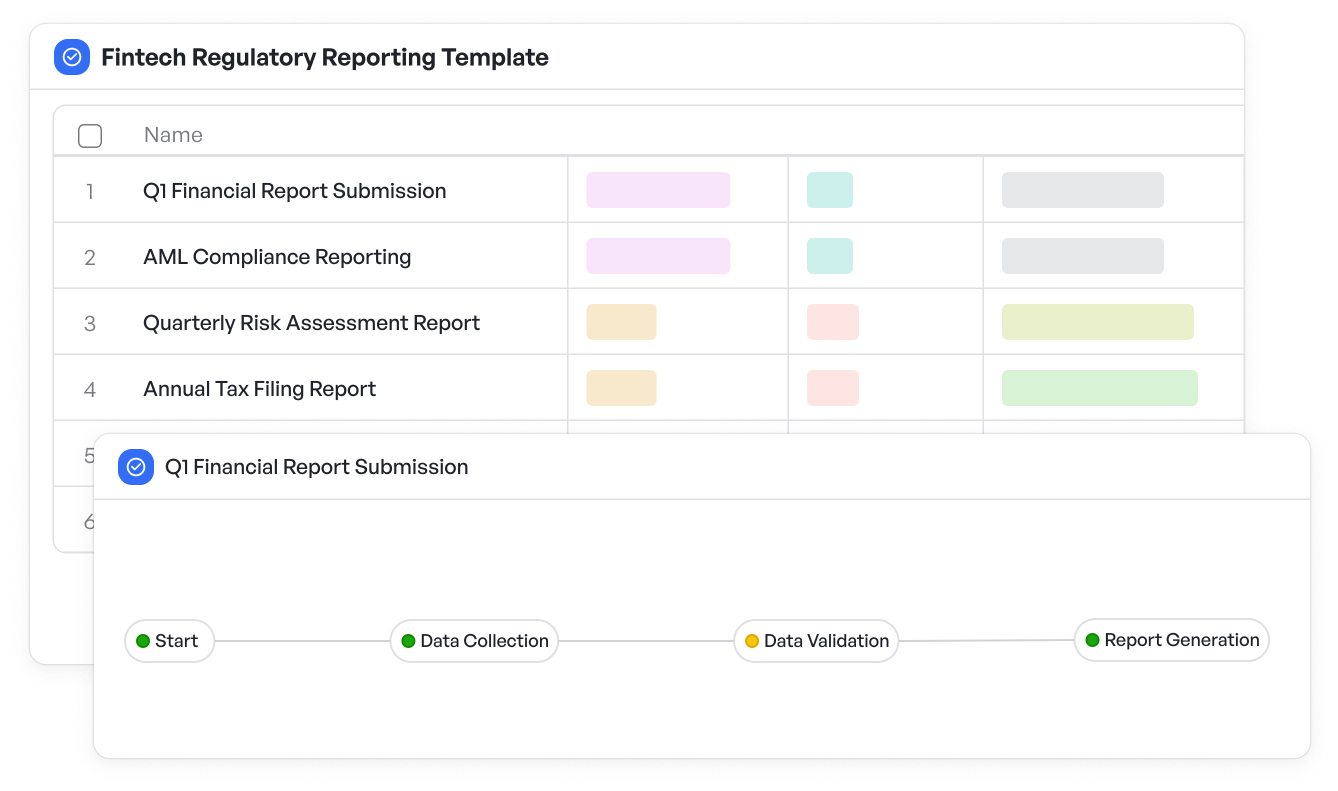

- Fintech regulatory reporting template: Helps teams manage compliance tasks and ensure all regulatory reporting requirements are met efficiently throughout the project lifecycle

- Fintech project lifecycle management: Streamlines financial reporting workflows, helping teams stay on track with deadlines, deliverables, and data integrity for timely reports

- Fintech risk assessment framework: Designed to map out potential risks, assess their impact, and establish mitigation strategies, ensuring Agile finance teams can proactively manage and adapt to financial uncertainties.

Streamline compliance tasks and ensure accurate regulatory reporting with the fintech regulatory reporting template

Streamline compliance tasks and ensure accurate regulatory reporting with the fintech regulatory reporting templateBy utilizing these visual workflow templates, Agile finance teams can enhance their ability to adapt, collaborate, and stay compliant while keeping projects on schedule and within scope.

Key Challenges Faced by Agile Modeling in Finance Teams

Without clear, adaptable models, finance teams often struggle with:

- Miscommunication and duplicated work

- Delays due to rigid documentation processes

- Difficulty adapting to changing regulations

- Lack of real-time visibility into project status.

Agile modeling addresses these by combining structure with flexibility.

The Role of Software Tools in Agile Modeling in Finance

Modern software solutions that support Agile modeling play a vital role in enabling finance teams to visualize workflows and collaborate. An ideal tool for finance teams should:

- Offer flexible visual workflow creation and editing

- Support real-time collaboration among multiple users

- Integrate with project management and compliance systems

- Be easy to use for both technical and non-technical users.

This balance of usability and power is essential, as finance teams often include diverse skill sets.

Achieve Greater Agility and Transparency with Agile Modeling in Finance Projects

Agile modeling brings clarity, flexibility, and collaboration to complex finance projects. By visualizing workflows and enabling iterative updates, finance leaders and their teams gain the insight and adaptability necessary to navigate today’s rapidly changing financial landscape.

Adopting Agile modeling can enhance project visibility, reduce delays, and improve compliance readiness, ultimately leading to better decision-making and faster delivery.

Bring control and transparency to financial project planning—experience Meegle’s agile modeling today.

The world’s #1 visualized project management tool

Powered by the next gen visual workflow engineRead More

Check All BlogsStart creating impactful work today